Revolut - Spend, send & save smarter

Unlock financial freedom with seamless spending, secure savings, and instant transfers tailored for the savvy American consumer.

- 10.94 Version

- 4.3 Score

- 35M+ Downloads

- Free License

- 3+ Content Rating

Join over 50 million users globally who utilize our app to manage their spending, sending, and saving more intelligently.

Ensure your expenditures are worthwhile.

Pay however you prefer, using physical cards, virtual cards, single-use virtual cards for increased security, Google Pay, or Apple Pay.

Travel abroad with favorable exchange rates (additional fees may apply to the rates offered).

Access more than 55,000 in-network ATMs around the world without incurring fees.

Connect your external bank accounts to monitor all of your transactions effectively.

Create a physical card that matches your style (fees could apply).

Empower your children toward financial literacy by getting them a Revolut <18 account with their own card, allowing them to learn about money safely and enjoyably.

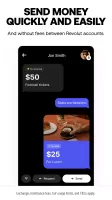

Transfer funds easily, no matter the distance.

Send or request over 25 currencies with just a tap to anyone, anywhere.

Communicate, send, and receive funds all from one platform. Whether you're making plans or sharing costs, P2P payments make transfers between your Revolut contacts nearly instantaneous.

Easily split bills and settle up in a single place. You can even lighten the mood by sharing a fun GIF.

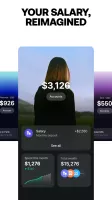

Save in an interesting way.

Enhance your savings with an impressive APY of up to 4.25%* through Savings Vaults. Access your savings whenever needed without penalties or fees.

Effortlessly grow your savings—establish recurring transfers and round up spare change to save extra cash.

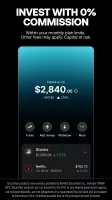

Dive into Stock Trading (capital is at risk).

Begin trading stocks with as little as $1 (other fees may be applicable).

Select from over 2,000 stocks to invest in some of the most well-known global companies.

Experience commission-free stock trading within your monthly allowance (other fees may apply).

All investments carry risks, including potential loss of principal. Investment accounts and disclosures might be shown together. Self-directed brokerage products are made available by Revolut Securities Inc., which is a member of FINRA/SIPC. Brokerage products are not insured by the FDIC, do not carry a bank guarantee, and may lose value. Automated investment services are managed by Revolut Wealth Inc., an SEC-registered investment advisor.

Avoid excessive spending.

Receive immediate notifications for each transaction to keep track of your expenses.

Utilize advanced budgeting tools and analytics to stop guessing where your money went and start directing it purposefully.

Concerned about upcoming payments or subscription fees? There’s no need—alerts will notify you in advance.

Consider upgrading to one of our premium packages to unlock exclusive cards, additional benefits, and exciting perks. Choose the plan that suits you best: Premium or Metal (subscription fees and conditions apply).

Activate security features that give you control.

Quickly freeze and unfreeze your card with a simple tap.

Employ single-use cards that generate fresh details with each use for added security.

Set spending limits and receive alerts to help you monitor your finances.

Learn about our security measures for your finances.

Our advanced fraud detection system identifies high-risk transactions and sends you alerts, allowing you to recognize scams early.

Thorough identity verification ensures secure sign-ups, and your account is safeguarded with passcodes and biometrics.

We provide around-the-clock assistance via our in-app customer support.

Funds in your account are deposited with or transferred to Lead Bank and are insured by the FDIC up to certain applicable limits in case of bank failure, provided specific deposit insurance criteria are met.

*The highest APY is assigned to customers subscribed to Premium or Metal plans. Annual Percentage Yield (APY) is subject to fluctuations. Current APYs are accurate as of October 20, 2023. Monthly fees apply for Premium and Metal options. Terms and Conditions apply. No minimum balance is required. Savings Vault services are offered by Sutton Bank.

Revolut Ltd is regulated by the Financial Conduct Authority under the Electronic Money Regulations 2011. The registered office is located at 107 Greenwich Street, 20th Floor, New York, NY 10006.

Open and manage additional currency accounts

Open an additional currency account

Go to 'Home' on the bottom menu

Below your balance, tap 'Accounts'

Tap 'Add new'

Choose 'Currency account'

You'll see a list of the available currencies to choose from

Follow the steps in-app to set up your additional currency account

Although you can hold and spend available currencies, it doesn't necessarily mean you can send or receive transfers with them. To see a list of unsupported countries for receiving transfers, head to this FAQ.

To find your Revolut account details, check this article in our Help Centre.

Deactivate or hide a currency account

Go to 'Home' on the bottom menu

Below your balance, tap 'Accounts'

Press the relevant account and swipe left to reveal options

Tap 'Deactivate' or 'Hide' (whichever applies)

This won't block incoming money, but will block spending from that account

You can deactivate currency accounts that have an available balance, but your main currency account cannot be deactivated or hidden. If an account has no balance, you can simply hide it, and it won't appear in your account list.

Accounts with zero balance don’t require deactivation, since there are no funds to spend. They will disappear from your list when hidden. However, if an account with a balance is deactivated, it won’t be available for spending, but it will still appear in the account list.

What currency account details are available for me?

Available details

All Revolut customers registered in the UK have access to:

GBP local account sort code and account number

SWIFT account for international transfers in all supported currencies

View your currency account details

In your Revolut app:

Go to 'Home' on the bottom menu

Tap 'Accounts'

Select the desired currency

Below your balance, tap 'Details'

If local details aren't available for the desired currency, you can check your SWIFT details. They will be marked as 'For cross-border transfers only' in-app. To learn which details you should use for incoming transfers, check this article.

Why is my balance now negative?

It could be a delayed payment

In areas with poor connectivity, the merchant may be unable to process the transaction or receive the payment immediately.

To complete the transaction, they might attempt to charge you again on a different day. This can result in a duplicate charge, where you see both a pending payment and a completed payment for the same merchant.

Both transactions might be reflected in your account balance, causing it to be negative. However, the pending transaction should automatically be cancelled or reversed. If not, you can dispute the transaction following the steps described in this FAQ.

Other common reasons

Final costs higher than expected: some merchants can block a certain amount on your account and adjust the final cost of the payment later. They may initially charge more than you expect, bringing your account into a negative balance, but later readjust the charge

Paid plan fees: if you don't have enough funds when Revolut paid plan fees are charged, it can push your account into a negative balance

Which transaction caused a negative balance?

To check your recent transactions and see which one may have brought your account into a negative balance, follow these steps in-app:

Go to 'Home' on the bottom menu

Open your transactions list

Review all your recent transactions in each currency account

Based on the negative balance and recent transactions, try to calculate or identify which transaction was the one to make your balance turn negative

If you find a transaction you don’t recognise that caused a negative balance in your account, check out this FAQ.

What happens if my balance goes negative?

We'll try to use money from your other currency accounts to bring your account back to a positive balance. If there isn’t enough money in your other currency accounts, we'll ask you to add money to your account the next day. After 7 days, we'll start our collection process as outlined in our T&Cs.

We may report it to debt registries, fraud prevention agencies, or debt collection agencies, which could impact your financial status and future credit or financial eligibility.

If you have a negative balance in your account, you won't be able to make card payments but your account will stay active. In case you're having financial difficulties, contact us. We’ll always do our best to help you.

- Version10.94

- UpdateAug 31, 2025

- DeveloperRevolut Ltd

- CategoryFinance

- Requires AndroidAndroid 7.0+

- Downloads35M+

- Package Namecom.revolut.revolut

- Signature400ae4116e5bda775b831acaa75d5e11

- ReportFlag as inappropriate

-

NameSizeDownload

-

341.61 MB

-

357.03 MB

-

354.39 MB

User-friendly and efficient interface

Fast and real-time transactions

Easy currency exchange while traveling

Built-in savings features like vaults

No fees for foreign ATM withdrawals (within limits)

Good customer support responsiveness

Multiple integrated financial services (crypto, investing)

Flexible options for online spending with disposable cards

Navigation issues after recent updates

Bugs leading to temporary inability to access funds

Difficulties with customer support and verification processes

Charges and fees that seem misleading or excessive

Inability to resolve login issues without old phone number

Slow transaction speeds for money transfers

Limited customization options for app interface

Confusing referral program causing user frustration