Raiffeisen E-Banking - Mobile banking & invoicing

Experience seamless banking on-the-go with instant access to accounts, investments, & secure payments all in one app.

- 8.13.0.376.376 Version

- 4.5 Score

- 491K+ Downloads

- Free License

- 3+ Content Rating

With the Raiffeisen E-Banking App, you have all E-Banking applications on your smartphone or tablet. Do you want to quickly check your account balance, place a stock market order, or scan and pay an invoice? No problem. With the E-Banking App, it's quick and easy. Start the app, log in with fingerprint or face recognition, and you can see your current balance. In the Mobile-Banking App, all E-Banking functions are available to you on the go. With your Raiffeisen E-Banking App, you also benefit from increased security, as it has an internal browser that can only be used to access the Raiffeisen Mobile Banking page.

Please note that by downloading, installing, and utilizing this application, third parties might infer a current, past, or future client relationship between you and Raiffeisen. By acquiring this app, you explicitly consent to the potential collection, transmission, processing, and accessibility of your data by third parties in accordance with their policies. Make sure to differentiate these third-party terms from those of Raiffeisen.

Raiffeisen E-Banking Functions

Print:

Manage your banking transactions conveniently wherever you have internet access.

Table of Contents:

Assets

Payments

Payment Recipients

eBill

Tax Documents

E-Documents

Card Self Service

Cards & TWINT

Cash Delivery Service

Investing

Messages and Notifications

Accessibility

Assets:

Access to accounts, portfolios, pension funds, and loans

Asset overview with graphical display

Account statement as a timeline or table view with easy date selection

Breakdown by currency, investment category

Payments:

Easy entry using the payment assistant

Payment orders for domestic and international transfers

Scan, import, and share QR invoices using your smartphone (app)

Payment Recipients

View all expenses for each payment recipient at a glance, grouped according to your preferences

Overview of all payment recipients' expenses

Create new payment recipient lists

Search for payment recipients

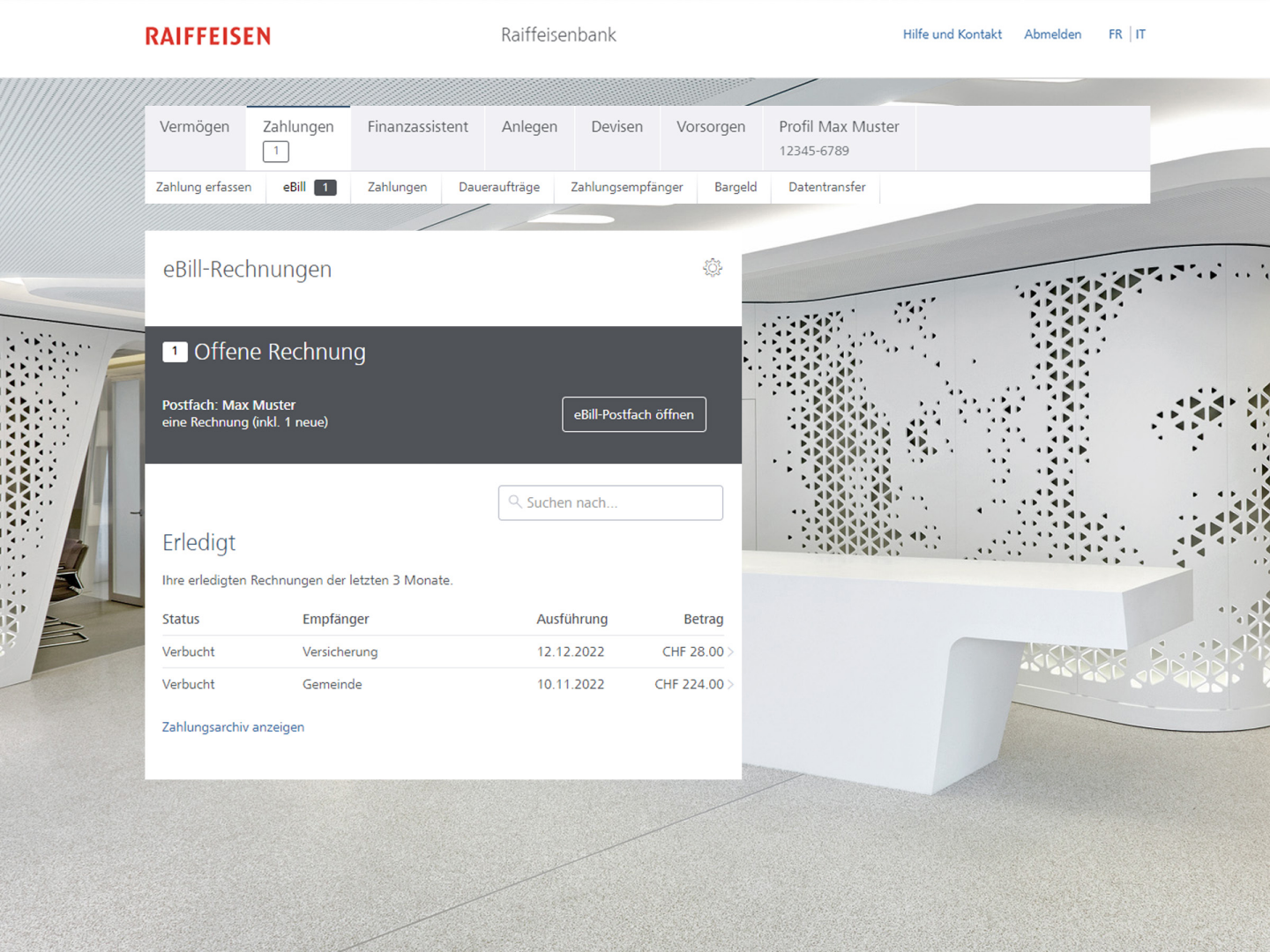

eBill

Your Benefits

Convenient: No more time-consuming and error-prone typing of reference numbers, invoice amounts, and account details in e-banking.

Fast: Pay invoices with just a few clicks.

Paperless: The invoice is delivered directly to your e-banking. You will no longer receive paper invoices.

Controllable: Check the invoice and simply reject it if something is incorrect.

Secure: eBill is as secure as your e-banking.

NEWS

Raiffeisen anticipates sharpest profit fall amid Russia exit pressure--Analysts say the bank’s net profits will fall 16 per cent, the greatest of its regional peers

by Anita Hawser

Raiffeisen Bank International is tipped to post the “steepest” drop in profits and interest income among major central and eastern European banks in the “coming quarters”, according to S&P Global Market Intelligence, as the lender comes under pressure from regulators to substantially curb its business in Russia.

According to analyst consensus estimates compiled by S&P Global Market Intelligence, the Austrian-headquartered bank is expected to post a 16 per cent year-on-year decline for 2024 net profit to €2bn, which “is the highest estimated profit drop among eight large banks headquartered in central Europe”, S&P analysts noted in a July 23 research note. RBI is scheduled to report half-year results on July 30.

The bank is anticipated to report the third-biggest drop in full-year profits in 2025, said the research note, behind Hungary-based OTP Bank Nyrt, and fellow Austrian lender Erste Bank.

Forecasts indicate Raiffeisen Bank International will experience the sharpest profit fall of its CEE peers

Net income estimates for CEE banks, ranked according to 2024 estimates, €bn

e = estimate | a = actual

RBI is also expected to record the highest annual decline in net interest income over the next two years, at 8.2 per cent in 2024 and 7.6 per cent in 2025. Its return on equity is also expected to hit the lowest among the analysed banks for each year. Analysts said RBI’s strategy and market positioning in CEE was weakened by the pressure the bank is under to significantly scale back its Russian business.

The Austrian bank is the largest foreign bank by assets still operating in Russia. In May, following threats from US authorities to shut it out of the US financial system, Raiffeisen’s Russian subsidiary suspended all outgoing US dollar payments.

The European Central Bank also called on RBI to speed up its withdrawal from the Russian market and to shrink its total customer loan book in Russia by 65 per cent by 2026, threatening penalties if it failed to comply.

According to a research note published by S&P Global back in April, the ECB’s requests are likely to entail a significant reduction in the profits Raiffeisen derives from its Russian subsidiary, which amassed 43 per cent of operating income from net fees and commission in 2023, compared to 52.2 per cent in 2022, according to S&P Global.

RBI has the largest exposure to Russia among EU banks, with the Russian business accounting for roughly half of its post-tax profit and more than 15 per cent of its risk-weighted assets in the first quarter of 2024, said S&P Global Market Intelligence.

In its first quarter financial report, RBI said it had “significantly reduced” its business in Russia since 2022, with loans to Russian customers falling by almost 60 per cent. However, with most Russian banks under western sanctions and cut off from the global financial system, Raiffeisen Bank had become the largest provider for US payments in Russia and a “window to the world” for Russian clients and companies still looking to do business with the west.

RBI has stated that it continues to explore a sale of its Russian subsidiary; however this will require the approval of Russian President Vladimir Putin. According to S&P Global Intelligence, RBI is also “in talks” to sell its Belarusian unit.

However, even without Russia, analysts believe the group is strategically well positioned in the region. Economic recovery in Austria and CEE in the next few years should lead to organic growth of RBI’s core business outside Russia and Belarus, acting as a “natural hedge”, according to S&P Global analysts.

Italian bank UniCredit is also under pressure from regulators to exit the Russian market.

In its second-quarter results presentation, UniCredit, the second-largest foreign bank in Russia by total assets, said it is pursuing an “orderly accelerated solvent wind down” of its Russian exposure “within the letter and the spirit of the legal, regulatory and sanction limitations [and] also to avoid Russia taking control of our assets and related value with cause”.

Net local loans and local deposits had declined by 68 per cent and 69 per cent respectively, according to Unicredit’s second-quarter results.

- Version8.13.0.376.376

- UpdateJul 20, 2025

- DeveloperRaiffeisen Schweiz Genossenschaft

- CategoryFinance

- Requires AndroidAndroid 9+

- Downloads491K+

- Package Namech.raiffeisen.android

- Signature9651ae27cd22c94ef05689f19af84b73

- Available on

- ReportFlag as inappropriate

-

NameSizeDownload

-

66.54 MB

-

65.03 MB

-

61.75 MB

User-friendly interface with payment scan functionality

Good integration with PhotoTAN for security

Excellent e-banking features and performance

Regular updates resolving technical issues

Notifications about service downtime in advance

Efficient expense management overview

Multiple language support (although not fully functional)

Ability to submit bills through scanning

Compatibility with various phone models

Limited visibility of real-time account balance

Frequent language resets to German upon reopening

Crashes or login issues after updates

Requirement for excessive authentication steps for login

Absence of custom budget options and categories

Difficulties in scanning payment slips

Poor user experience due to outdated UI/UX design

Inconsistent biometric login functionality

Persistent bugs causing app instability on different devices