Australian Taxation Office - Tax info & filing

Maximize deductions, lodge tax returns, monitor payments, and access tax information

- 6.0.25 Version

- 4.1 Score

- 1M+ Downloads

- Free License

- 3+ Content Rating

The ATO app enables users to conveniently manage their tax and super affairs on-the-go, streamlining the process and making it simpler. To access personalized tax and super features, a myGov account linked to the ATO is essential.

Australian Taxation Office Tips

1. Separate Business and Personal Finances

Open a Dedicated Business Account: Keep your business income and expenses separate from personal finances. This clarity helps in accurate reporting and reduces the risk of audits.

Record All Transactions: Maintain detailed records of all business transactions, including income sources and expenses, to support your claims.

2. Accurate Deductions and Claims

Understand Deductible Expenses: Only claim deductions directly related to your business activities. Common deductible expenses include:

Work-related tools and equipment.

Costs of managing your tax affairs (e.g., accounting fees).

Charitable donations to registered organizations.

Keep Documentation: Retain invoices, receipts, and any relevant paperwork to substantiate your claims. This documentation is crucial if the ATO requests evidence during an audit.

3. Timely Lodgment of Tax Returns

Lodge on Time: Ensure you submit your tax returns by the due date to avoid penalties. Set reminders for key dates to keep track of your obligations.

Use Digital Payment Systems: Embrace electronic payment methods for transactions, as they provide a clear trail of income and expenses.

4. Stay Informed About ATO Focus Areas

The ATO regularly reviews compliance behaviors. Key focus areas include:

Correctly claiming deductions.

Reporting all income accurately.

Avoiding cash-only transactions that may attract scrutiny.

5. Engage with the ATO Proactively

If you encounter difficulties meeting your tax obligations, contact the ATO early to discuss payment plans or seek assistance from a registered tax professional.

Utilize the ATO’s resources, such as their website and helplines, for guidance on specific tax issues or changes in legislation.

6. Utilize Available Concessions

Small businesses can benefit from various concessions, such as the instant asset write-off for eligible assets costing less than $20,000. Ensure you understand how these concessions apply to your situation.

7. Monitor Changes in Tax Legislation

Stay updated on changes in tax laws and rates that may affect your business or personal tax situation. The ATO’s website is a valuable resource for announcements regarding tax cuts or new regulations.

8. Seek Professional Advice

If you’re uncertain about any aspect of your taxes or compliance requirements, consider consulting with a tax professional. They can provide tailored advice based on your specific circumstances.

Users can benefit from the following features with the ATO app:

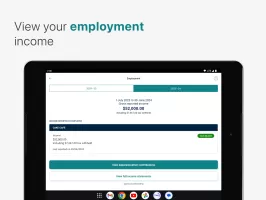

- Track their 2023-24 tax return progress, including prefill information, status updates, and final outcomes

- Receive real-time notifications for lodgments and payments due, and easily complete them through ATO Online

- Utilize secure and streamlined login processes via device security features like face and fingerprint recognition

- Access tax accounts and link to ATO Online for transaction viewing, payment plan setup, and payments

- Review their super balance, accounts, employment income, and required superannuation contributions from employers

- Verify personal, business (sole traders only), and registered agent details

- Access popular tools such as myDeductions, Tax withheld calculator, ABN Lookup, and Business performance check

Additional tools available in the ATO app include:

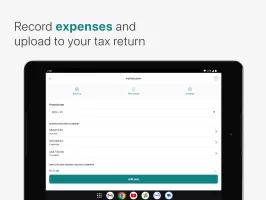

- myDeductions: Record work expenses for employees or sole traders, with the option to upload them easily during tax time

- Tax withheld calculator: Calculate the appropriate amount of tax to withhold from salary and wage payments

- ABN Lookup: Search for an Australian Business Number (ABN)

- Business performance check: Compare business performance with industry benchmarks using Small Business benchmarks

Users have the option to allow the app to automatically send usage data for performance improvement. This data remains anonymous, and users can disable this feature in the app settings at any time. It is important to note that GPS may be used to track trips in myDeductions, which could drain battery life if consistently active in the background.

- Version6.0.25

- UpdateFeb 02, 2025

- DeveloperAustralian Taxation Office

- CategoryFinance

- Requires AndroidAndroid 8.0+

- Downloads1M+

- Package Nameau.gov.ato.ATOTax

- Signature030b082c1ef0be9677d9ebf728393441

- Available on

- ReportFlag as inappropriate

-

NameSizeDownload

-

45.19 MB

-

45.31 MB

-

45.30 MB

See in real time when contributions and payments are due

Use your device's secure login

Can't get rid of ads